For seniors who may be purchasing final expense insurance, it’s likely they are finding the process somewhat challenging, especially if they have health issues to contend with. Not only is life insurance hard to understand, but having companies decline your case because it shouldn’t have been submitted to them in the first place can be extremely disappointing. Insurance companies have various underwriting guidelines where what’s acceptable to one company might be denied by another. If this is something that you’ve been dealing with, Life Policy Shopper is available to take the guesswork out of applying for insurance. Here we’ll discuss unbelievable $9,000 final expense insurance quotes.

What is Final Expense Insurance?

Final expense insurance also referred to as burial insurance or funeral insurance, is a permanent insurance policy designated to pay for the final expenses most seniors leave after they’ve passed away. These final expenses are typically made up of funeral and burial costs, unpaid nursing home expenses, and unpaid medical bills. Typically, the most substantial final expense is the cost of a funeral and burial.

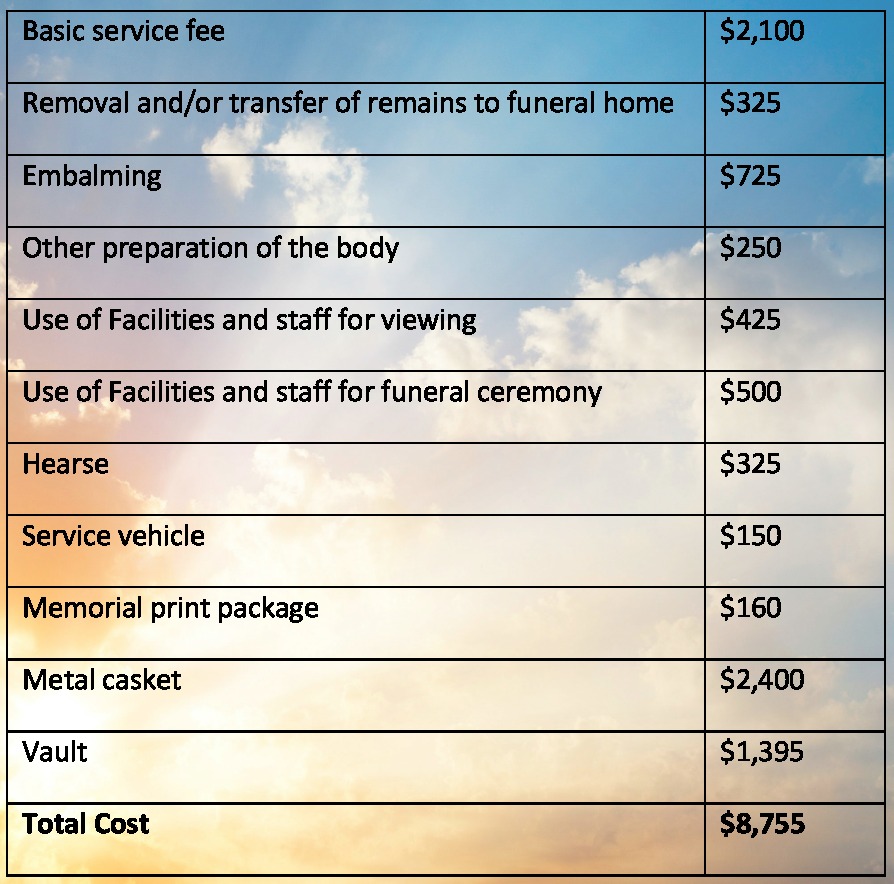

According to the National Funeral Directors Association, there are many factors that are involved in the final cost of a funeral, but on average, consumers should expect the following:

National average cost of an Adult Funeral with View and Burial Service:

It’s important to note that the services listed above are typical for an average funeral but no all or necessary. For example, many churches will hold a memorial service for members at no charge and many states do not require embalming, especially if the funeral is within a few days of death. It’s also important to note that the Total Cost listed above does not include the cost of the gravesite.

What about other Methods of Paying for the Funeral?

Certainly, there are options when it comes to paying for a funeral in advance and it’s a financial decision that you should consider:

- Pay a discounted price up front in cash. Many funeral homes will offer discounted funeral service packages if you agree to pay in cash and in advance. The advantage is that you can save money on the cost of your funeral however if the funeral home goes bankrupt or out of business you’ll likely lose your investment.

- You can set up a pre-need contract with a funeral home that allows the funeral home to invest the money in hopes of being able to pay the cost of the funeral at a future date. The downside is that if the account does not accumulate sufficient funds for the funeral, your surviving loved ones will likely have to pay the unpaid balance.

- Funds from the Deceased’s estate can be used to pay for the funeral however, it can take time for the estate to go through probate and most funeral homes will expect payment in advance of the service.

Do I have to Qualify to Get the Best Rates?

Yes, to get the best rates on final expense insurance there are numerous questions about your health on the application, however, in most cases, you will not have to have a medical exam. Traditional final expense insurance offers a level death benefit and first-day coverage where guaranteed issue or guaranteed acceptance policies do not.

Your insurance rate and the type of plan you qualify for will depend on your answers to the health questions and typically more than two “yes” answers can disqualify you from coverage and your only option will be to purchase a guaranteed issue policy which is more expense and has a waiting period before the company will pay the full death benefit if you die from natural causes.

How Much Will I Have To Pay for Coverage?

Listed below is a common scenario where an applicant is looking for enough final expense insurance to cover a funeral with a particular health condition that most companies will not accept, but we represent several companies and can almost always find level death benefits with first-day coverage:

Harry Smith

Harry is looking for a $9,000 final expense insurance quote. He is currently being treated for Hepatitis C.

In Harry's case, he may not qualify for a level benefit first-day coverage final expense policy with many companies, however, Life Policy Shopper can offer a $9,000 Final Expense Quote for only:

|

Applicant Age |

Male Non-Smoker |

Female Non-Smoker |

|

50 |

$31.99 |

$28.69 |

|

55 |

$43.04 | $33.97 |

| 60 | $53.78 |

$39.82 |

|

65 |

$73.66 | $52.08 |

| 70 | $97.17 |

$67.73 |

|

75 |

$133.05 |

$92.35 |

|

80 |

$192.62 |

$132.02 |

As you can see from this rate chart, Life Policy Shopper represents the companies who are willing to offer level benefit policies that offer first-day coverage. When other agents have to go to the guaranteed issue market, we are able to find affordable final expense insurance for seniors, even when being treated for Hepatitis C.

To get the most affordable $9,000 Final Expense Quotes, even with certain serious illnesses, contact the insurance professionals at Life Policy Shopper at (540) 226-8715 during normal business hours, or contact us through our website at your convenience.

Last Updated on June 27, 2018 by lifepolicyshopper